I have been working as a freelancer for as long as I can remember. And I’m not just talking about creating content or blogging (those are my passion-fueled side hustles hehe), I’m talking about my work as a Virtual Assistant, SEO writer, Social Media Manager & Influencer Coordinator for international clients! :) I started doing online jobs or remote work back when Upwork was still oDesk—yes, way back in 2013!

Back then, getting paid wasn’t as smooth as it is now. Since I get paid in $ (TYL haha) transferring funds used to come with lots of fees and extra steps. Now, it’s all simplified and easy! Read on to know more…

When you’ve been freelancing for as long as I have, you learn to stick to tools that actually work. For the longest time, I’ve been using one trusty app to handle my cash flow chaos—Maya! In this freelance world, we know nothing is permanent. Clients come and go, deadlines shift, but Maya? Maya has stayed. And not just stay—it’s leveled up with me!

Here’s why Maya has been my ultimate freelance partner all these years:

1. Free PayPal Transfers – For years now, it’s my go-to when transferring payments from my US-based client (and other side projects) through PayPal, and it’s always been hassle-free. Now, with free PayPal transfers (₱250 cashback when I transfer ₱7,000 or more!), it feels like I’m getting paid to get paid. Freelance win!

|

| I have my Maya account linked to my Paypal account so I can easily transfer my earnings! |

2. High-Interest Savings – While waiting for clients to pay, I park my money in Maya Savings. With up to 15% p.a. interest per annum, my funds grow while I sleep—or while I’m editing content and replying to emails at 2 AM.

|

| The higher your savings, the higher your p.a interest earnings! |

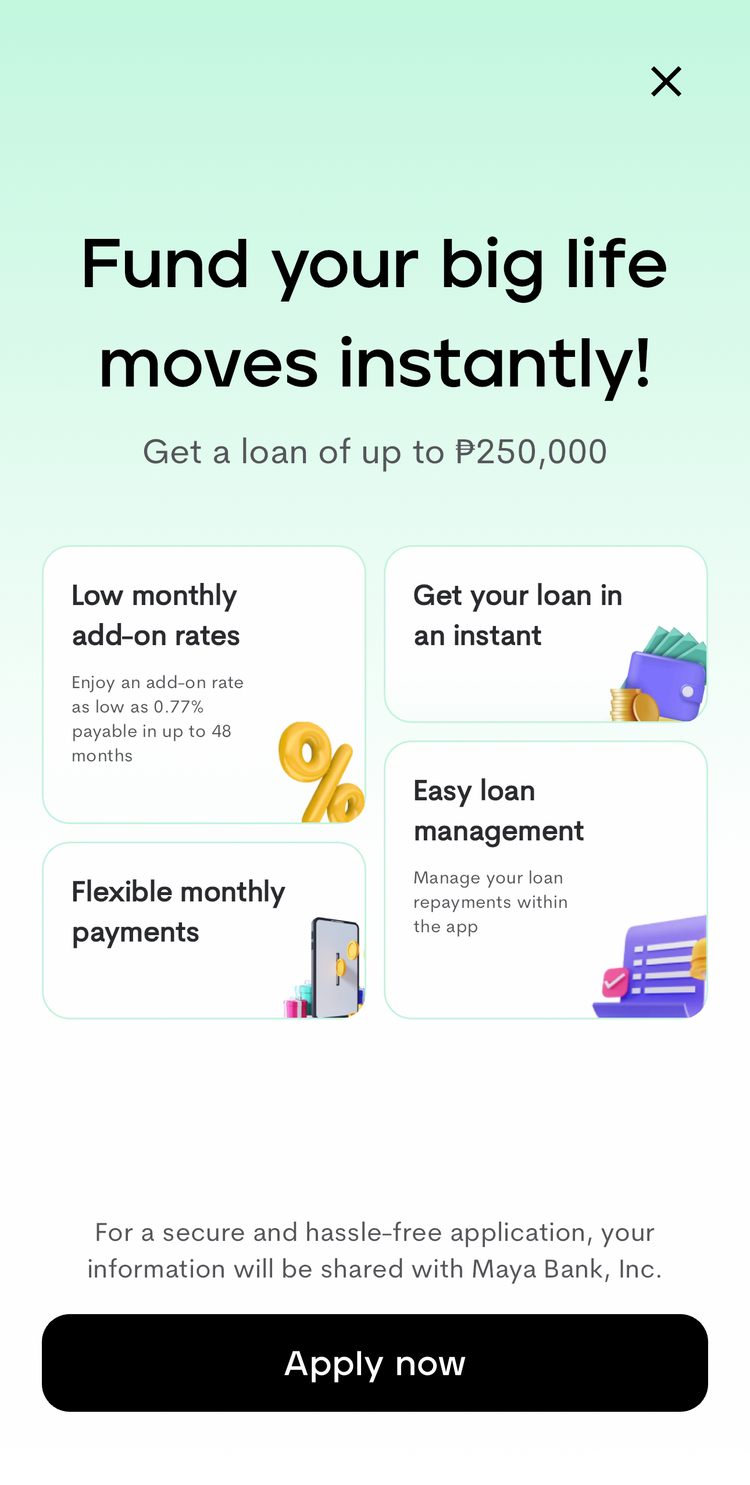

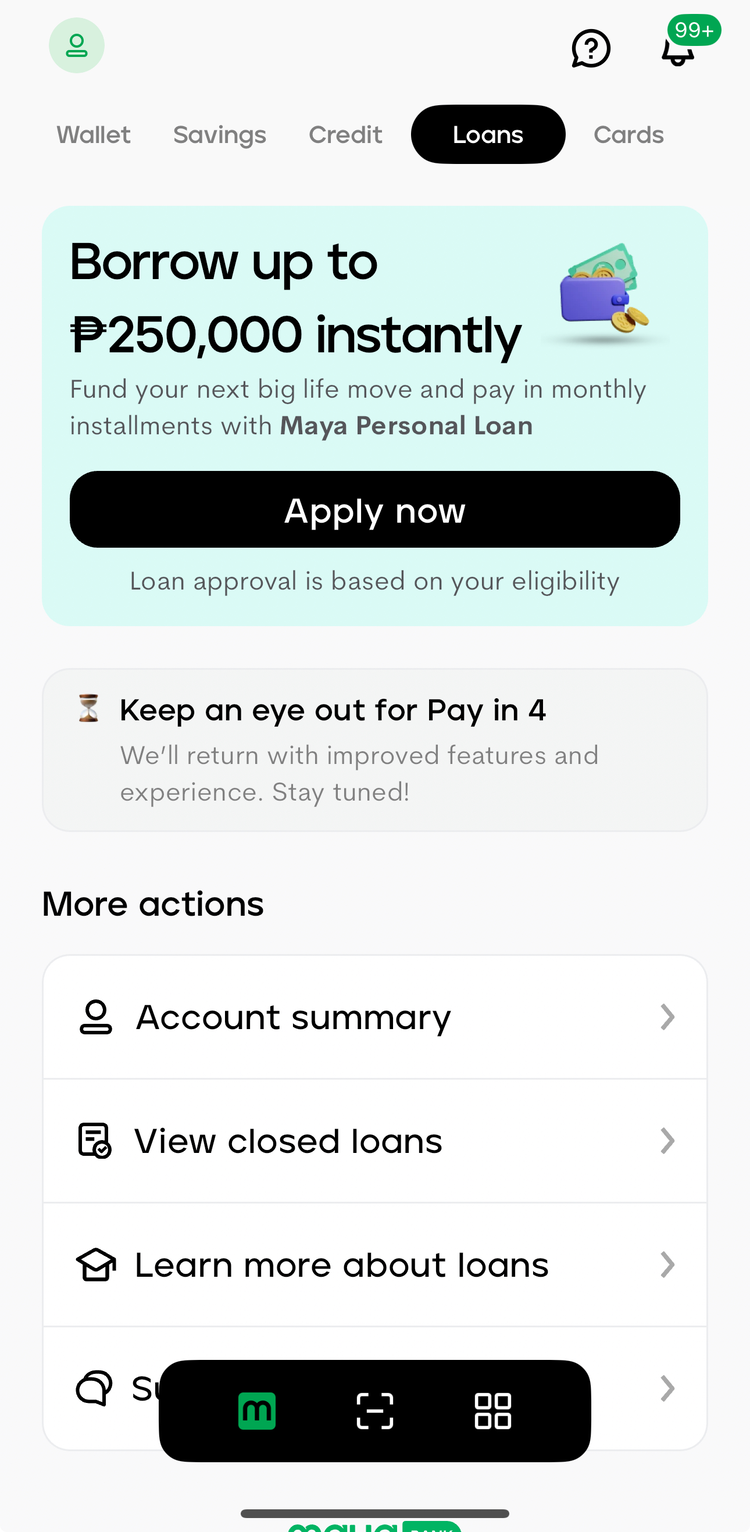

3. Access to Credit – Sometimes, gigs come before the payout. Maya Easy Credit gives me instant access to up to ₱30,000—perfect for financial emergencies. Plus, the Landers Cashback Everywhere Credit Card gives you up to 5% cashback at Landers Superstores, while the Maya Black Credit Card lets you earn Maya Miles on every swipe.

4. Income Protection that’s Actually Affordable – For as low as ₱1,196/year, you can get yourself Singlife’s Cash for Income Loss (Accidents) via the app (you can earn P500 when you purchase any Singlife plan for the first time). There are other plans too, like Cash for Goals and 3-in-1 Protection—because freelance life doesn’t usually come with HR and benefits, but Maya makes sure we’re still covered.

Why Maya Works for the Freelance Hustle Lifestyle

2. One-stop wallet. From bills payments to subscriptions, everything funnels through a single dashboard, making bookkeeping easy peasy.

3. 24/7 mobility. Whether I’m sending funds at midnight or paying bills between shoots, it’s always just a tap away. No waiting, no fuss—just freedom to work (and bank) anytime, anywhere.

4. Rewards that add up. Cashback, interest, promos—little boosts that cushion the inconsistent inflows every freelancer knows too well.

|

| I use Maya to pay for my bills! So convenient! |

So if you’re out here freelancing like me, wondering how to make your money work harder while you hustle smarter, Maya’s your low-maintenance, high-reward partner. No ghosting, just growth. 💸💚

Download MAYA today and thank me later—because freelancers deserve more than just flexible hours. We deserve smart, flexible money tools too! :)

No comments:

Post a Comment

Thank you for visiting my humble blog! I read all your comments (even though I don't reply often). So keep them coming! Love to everyone:)